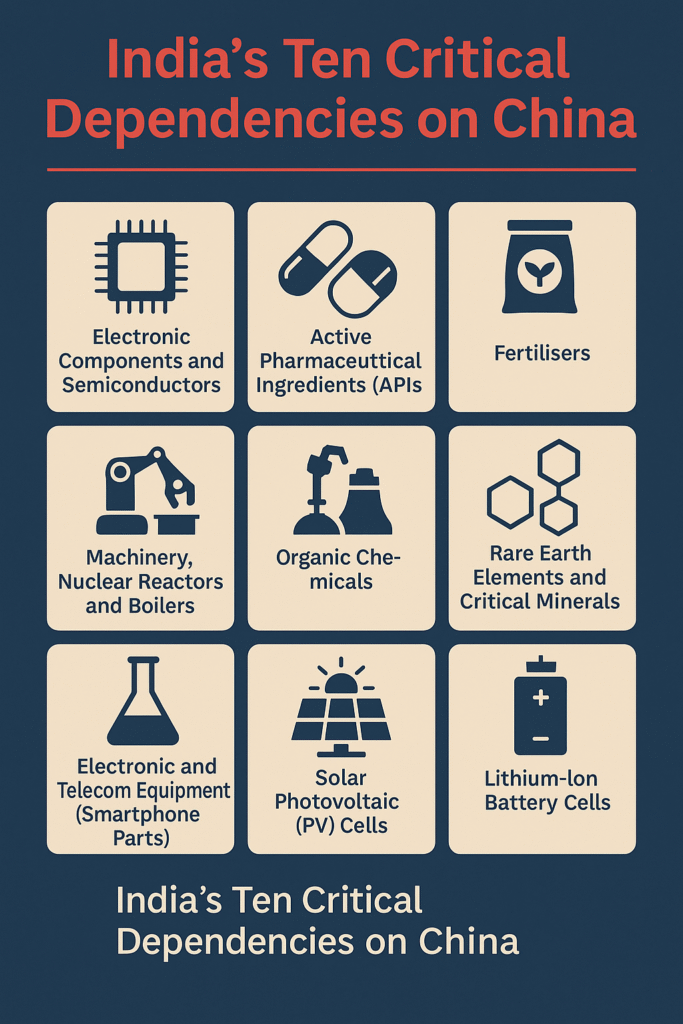

In recent years, the geopolitical landscape has underlined the importance of economic self-reliance. However, India remains significantly intertwined with China, especially in its import portfolio. India’s dependency on China stretches across critical sectors, affecting its strategic autonomy and economic resilience.

This article explores the top 10 most critical areas where India depends on China, backed by real trade data and industry insights. From semiconductors to solar panels, the stakes are high and the need for diversification is urgent.

1. Electronic Components and Semiconductors

India imported electronic and telecommunication equipment worth USD 44.15 billion from China in 2023, accounting for 62% of its total electronic component imports. Key items include:

Integrated circuits

Diodes

Transistors

Printed circuit boards (PCBs)

Camera modules

Display modules

India lacks robust semiconductor fabrication capabilities, forcing reliance on Chinese electronics giants. The country’s growth in electronics manufacturing under Make in India remains limited to assembly, without vertical integration.

2. Active Pharmaceutical Ingredients (APIs)

India is the world’s third-largest pharmaceutical producer, but ironically, it depends on China for 70–80% of its API needs. In 2024, API imports from China were valued at USD 2.3 billion.

APIs for essential medicines such as ciprofloxacin and norfloxacin have 100% dependency. This poses a serious risk for India’s public health system, especially during global emergencies like COVID-19.

3. Machinery and Industrial Equipment

China remains India’s top supplier of industrial equipment, especially for sectors like:

Nuclear reactors

Boilers

Compressors

Vacuum pumps

Imports from China in this category reached USD 21.70 billion in 2023. India’s heavy industries and manufacturing sectors rely on these for capital investments and upgrades.

4. Organic Chemicals

India imported USD 13.27 billion worth of organic chemicals from China in 2023. These are vital raw materials used in:

Pharmaceuticals

Agrochemicals

Paints and dyes

The lack of large-scale indigenous production capacity makes this another strategic chokepoint.

5. Smartphone and Telecom Equipment

The telecom industry, including smartphones, depends heavily on Chinese-made components. In FY 2023–24, USD 4.2 billion worth of smartphone parts were imported:

Lithium-ion batteries

Copper tubes

Open-cell display panels

Despite the growth of Indian smartphone assembly, core parts still originate from China.

6. Fertilisers

Agriculture, the backbone of India’s economy, is vulnerable due to its dependence on China for fertilisers. In 2023:

USD 2.61 billion worth of fertilisers were imported

Diammonium phosphate and urea formed the bulk

Chinese pricing and supply fluctuations directly impact Indian farmers and food security.

7. Iron and Steel

India’s engineering and automotive industries rely on USD 2.62 billion worth of finished steel imported from China. High-grade ferroalloys, essential for:

Car manufacturing

Infrastructure projects

This dependency not only affects cost but also domestic competitiveness.

8. Rare Earth Elements and Critical Minerals

China dominates the global processing of rare earth minerals such as gallium and germanium. In FY 2024–25:

India imported 57,000 tonnes of rare earth magnets, 93% of which came from China.

These are essential for:

Electric vehicle motors

Wind turbines

Missiles and radar systems

9. Solar Photovoltaic (PV) Cells

Despite a major solar push, India imports most of its solar cells and modules from China. In FY 2024–25:

4.55 billion PV units were imported from China

Over 60% of solar imports were Chinese

Indian companies like Vikram Solar and Waaree Energies exist, but lag behind in scale and efficiency compared to Chinese competitors.

10. Lithium-Ion Battery Cells

With the EV revolution underway, India’s dependency on China for lithium-ion battery cells is concerning. In 2024–25:

Imports worth USD 2.2 billion

75% came from China

These cells are pivotal for:

Electric cars

Energy storage systems

The Bigger Picture: What Can India Do?

Diversify Supply Chains: Countries like Vietnam, Taiwan, and South Korea are emerging alternatives.

Boost Domestic Production: PLI schemes and Atmanirbhar Bharat must prioritize high-tech manufacturing.

Strengthen Global Partnerships: Collaborations with Japan, the EU, and the U.S. can enable tech transfers and innovation.

Conclusion

India’s dependency on China spans critical sectors—from health and energy to manufacturing and agriculture. This overreliance exposes the nation to severe supply chain shocks, price manipulation, and geopolitical pressure.

To mitigate these risks, India must act decisively by building self-reliance, diversifying trade partners, and fostering innovation. Only then can it secure long-term economic and strategic independence.

Frequently Asked Questions (FAQs)

How much is India dependent on China?

India is significantly dependent on China, especially in electronics, pharmaceuticals, machinery, chemicals, and renewable energy. For instance, over 62% of India’s electronics imports and 70–80% of APIs come from China.

Which country is India most dependent on?

China is India’s most critical import partner across many sectors, making it the country India is most dependent on for industrial inputs and manufacturing components.

Who is India’s No 1 trading partner?

As of 2025, China remains one of India’s top trading partners, with bilateral trade exceeding USD 120 billion, followed closely by the United States.

Is China dependent on India?

While India is more dependent on China than vice versa, China does import iron ore, cotton, and certain agricultural products from India. However, the dependency is not reciprocal in scale or strategic value.

India is dependent on China for which products?

Key products include:

Electronic components

APIs (pharmaceutical ingredients)

Industrial machinery

Fertilisers

Solar PV cells and lithium-ion batteries

India imports from China

India’s major imports from China include:

Electronic items

Machinery

Chemicals

Fertilisers

Telecom parts

Solar equipment

India-China trade deficit last 10 years

The trade deficit has consistently ranged between USD 45–60 billion annually over the last decade, with imports heavily outpacing exports.

India-China trade deficit 2025

As per early 2025 data, India’s trade deficit with China stands at approximately USD 58 billion, driven largely by electronic and chemical imports.

India-China trade deficit 2014

In 2014, the trade deficit was around USD 37.8 billion, reflecting a growing imbalance over the last decade.

India-China bilateral trade 2025

Bilateral trade in 2025 has exceeded USD 120 billion, with India importing the bulk of goods.

India trade with China

Trade with China is a vital part of India’s global commerce, particularly in high-tech, chemicals, and energy equipment sectors.